It all started with delayed or missed payments against the home loan obligation.

Those who have been granted a Housing Loan by the Pag-IBIG Fund should be aware that three (3) missed payments on the monthly amortization could lead to foreclosure — a sort of disaster.

What would you do if your property is on the brink of foreclosure and you are facing financial difficulties as well?

We can’t tell how many of our visitors are into that situations.

If you know someone who is facing foreclosure, or has already defaulted on their amortizations, please help them out by sharing this article. This article could save them, or their house for that matter.

A Visitor’s Comment: “Last year my husband applied for a housing loan and it was approved, but now we have missed more than 3 payments. Is it possible to repay the missed payments and reduce the mortgage term of the loan? What step should we do? Thanks!”

Special Note: Pag-IBIG Fund is currently running a Housing Loan Restructuring and Penalty Condonation Program. The program started last January 2, 2012 and will end June 30, 2012. After June 30, only the loan restructuring will be entertained. Members who have missed paying their monthly amortizations for more than three (3) months may avail of this program.

Condonation means the relief given by law in the payment of penalties, surcharges and a portion of accrued interest to be determined by the Pag-IBIG Fund.

Loan Restructuring refers to a process where the principal terms and conditions of the original loan are modified in accordance with an agreement setting forth a new plan of payment or a schedule of payment on a periodic basis.

Related: Pag-IBIG Housing Loan Default and Foreclosure

Loan Restructuring : Refinancing Under Financial Distress

There are many reasons why borrowers default on their loan payments. Luckily for the Pag-IBIG members, there’s a Loan Restructuring program that they can take advantage of as a remedy to their delinquent accounts.

There are many reasons why borrowers default on their loan payments. Luckily for the Pag-IBIG members, there’s a Loan Restructuring program that they can take advantage of as a remedy to their delinquent accounts.

Here are the benefits of the Loan Restructuring Program:

- It allows the home owner to save the property from being taken away from them through the foreclosure process.

- It allows the borrower to shorten or lengthen (and thus the term “restructure” ) the term of the loan, whatever is deemed an affordable loan term for him.

- Interests and penalties due during the delinquency period could be waived.

See also : Foreclosure Properties — To Buy Or Not To Buy?

Who Can and Who Can’t Apply For the Home Loan Restructuring Program?

- Member-borrowers who have not yet availed of any penalty condonation program from any Government Financial Institution, for example, HDMF, GSIS, SSS.

- Borrowers who have missed payments on their monthly amortizations for at least 3 months.

- Borrowers whose property was already endorsed for foreclosure, but whose redemption period has not yet lapsed.

- Borrowers whose property was already foreclosed but the winning bidder is the Pag-IBIG Fund.

- Legal heirs of deceased borrowers with unpaid loan balances after application of the proceeds of the Mortgage/Sales Redemption Insurance (MRI/SRI).

- Successors-in-interest of borrowers who have assumed the original mortgage as supported by legal documents duly approved by the Fund.

However, Pag-IBIG is very strict against some accounts that should not be eligible to avail of this program. The following accounts are exempted from tapping this benefit:

- Any account without a single payment since takeout, including those whose only payment resulted from its deduction from the takeout proceeds.

- An account in which the housing unit has been abandoned by the borrower for more than one (1) year from date of delinquency.

- An account in which the housing unit is occupied by a third party other than the original registered beneficiary or his/her legal heirs or successors-in-interest.

- An account that has been foreclosed and another party is the winning bidder.

- An account that has been foreclosed and with expired redemption period.

- An account under a Contract-to-Sell that has been cancelled.

- An account that has been surrendered to the Fund through Dacion en Pago, the title of which had been consolidated or transferred in the name of the Fund.

- A Contract-to-Sell account covered by the developer’s buyback guarantee.

About The New Restructured Housing Loan

The following are among the most important things you should know about the new restructured loan.

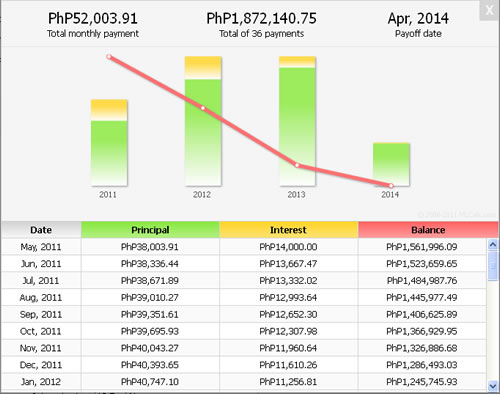

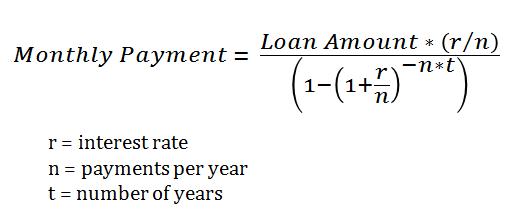

Loan Term — The Home Development Mutual Fund offers a very generous loan term of up to 30 years on the newly restructured housing loan. However, it should be noted that the age of the borrower must not be more than 70 by the time the loan matures.

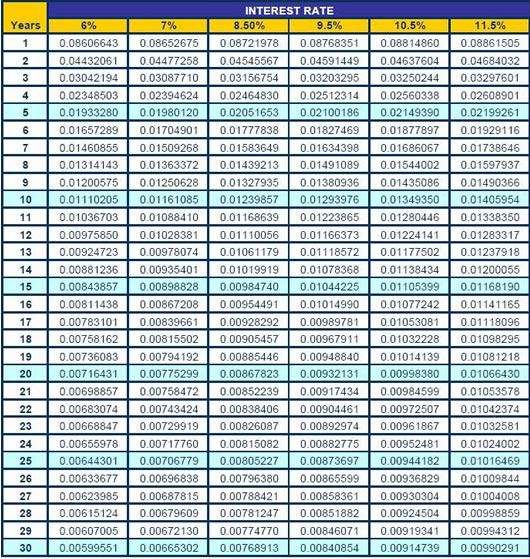

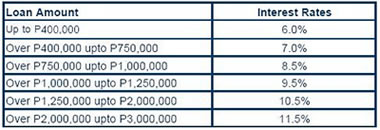

Interest Rate — The interest rate is 12% per annum or the rate of the original loan, whichever is lower and must be applied against the interest-bearing portion of the loan amount.

Penalty — If the borrower fails to pay any amount due on or before the due date he will charged a penalty of one-twentieth of one percent (1/20 of 1%) of the amount due for the month per day of delay.

Repricing — If the original loan amount is more than Three Hundred Thousand Pesos (P300,000.00), the new restricted loan shall be subject to repricing every three years, reckoned from the date of approval of loan restructuring.

Compare This With: The Current Rates of Interest and Penalties of Pag-IBIG Loans

What To Do Next?

If you are now so eager to restructure, please visit the Pag-IBIG Office that has the jurisdiction of your account and possibly your mortgaged property. Inquire about the full details of this program.

Plus, remember that the penalty dues will only be condoned when you apply not later than June 30, 2012. (As far as this current program is concerned.)

After reading this article, I hope that you will share this to a friend who is also a member of the Pag-IBIG Fund just so he/she knows what to do when foreclosure clock begins to tick.

~~~

“Home Loan Restructuring Program” is written by Carlos Velasco.