Certificate of Titles 101

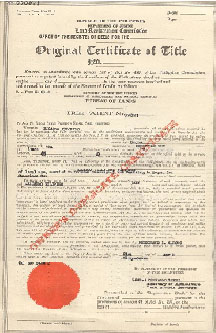

In real estate, the term “Title” generally refers to the evidence of ownership a person has over a property. Title comes in many forms including the Tax Declaration and Deed of Sale, to mention just two. What we normally mean when we say Title is the Certificate of Title likewise known as Torrens Title. The Torrens System is an old, long-surviving system of land registration method developed by Sir Robert Richard Torrens and was originally used in Australia. It is highly reliable and has been adopted by many countries in the world, including the Philippines.

A Certificate Of Title is the best evidence of ownership of a piece of real estate, such as land or a condominium unit. It is also considered indefeasible, meaning it cannot be annulled, defeated, or made void by any past event, or error or omission in the title.

In other words, the owner of a piece of real estate is the one whose name is indicated in the Certificate of Title. It follows that this is a very important legal document.

Below are some tips you should remember if you are to buy real estate in the Philippines.

Tip #1: Buy Only Titled Properties

There are still vast amounts of land in the Philippines that have no Land Title under the Torrens System. Usually, the only proof of ownership that the seller has is a Tax Declaration. Buying this type property is a perfect recipe for a real estate disaster. As a buyer, you don’t want to get involved with this kind of real estate deal.

There are still vast amounts of land in the Philippines that have no Land Title under the Torrens System. Usually, the only proof of ownership that the seller has is a Tax Declaration. Buying this type property is a perfect recipe for a real estate disaster. As a buyer, you don’t want to get involved with this kind of real estate deal.

Ask the seller to hand you a photocopy of the Title. Take note of the Title Number and the indicated name of the owner. To verify the Title at the Registry of Deeds, you will need at least the Title Number and the Name of the owner of the property. The next tip, should be of great help to you.

Tip #2: The Title Must Be Authentic and Accurate

This part is very important. Take this step very seriously.

Always request a Certified True Copy of the Title from the Registry of Deeds that has jurisdiction of the property. You simply can’t trust the seller’s broker or agent to handle this part. You have to personally do it, or have someone you can trust do it on your behalf.

Once you got hold of the title’s Certified True Copy, compare this with the photocopied Title handed to you by the seller or his broker. There should not be any inconsistencies or discrepancies.

Tip #3: The Title Must Be Clean, Free From Liens and Encumbrances

A clean title simply means one that has no encumbrances or liens. Liens, Encumbrances, and other annotations are printed at the back portion of the title.

Take a look again at the Certified True Copy of the Title. Is the back page clean? It should not have any unnecessary words or sentences other than those related to the property’s technical descriptions.

Special Note: Some Titles have very long descriptions that span more than just the front page. If you are not sure about the things written at the back portion of the Title, please consult it with your lawyer or someone who is an expert in handling such cases.

Tip #4: Double Check If The Property Being Sold Is What Has Been Stated In The Title

This sounds crazy, but some unscrupulous sellers will show you a property and show you a completely different land title, which doesn’t correspond to it.

The Title will always indicate a technical description of the property, its exact location and its boundaries. It would help if you can tap the services of a Geodetic Engineer or a Licensed Surveyor. You can request that such professional verify the accuracy of the land being described and, if possible, make conduct a re-survey of the land.

~~~

“Tips on Buying Titled Real Estate In The Philippines” is written by Carlos Velasco.