One of the requirements before a member can avail of a Housing Loan from the Home Development Mutual Fund or simply Pag-IBIG is to attend a housing loan seminar. If you have not been to that kind of seminar before, here are the essential things that they cover:

- An overview of the Housing Loan Program. Luckily, most of the contents of this website are focused on this topic, too. That means if you have been browsing around for quite some time, you already have a good deal of knowledge about the Housing Loan in general.

- Question and Answer. For those who are really serious about taking a home loan, you can ask the presenter of the seminar any topic that you want to raise that’s related to the program or your particular situation. If there have been questions bothering you regarding the housing loan, this is a good time to ask those and get official answer. So before to ever go to the seminar, it would be good if you prepare a list of your questions.

- Membership Status Verification. Before you can even apply for a housing loan, the Pag-IBIG Fund has to take a look at the details of your membership. They will ask you to fill up this small slip and submit it to the Pag-IBIG staff who will be checking on your membership status while the seminar is going on. Just before the seminar ends, you then get a verification whether you qualify for a housing loan or not.

It’s really that easy. Take note that a big part of the seminar is spent discussing the details of the Housing Loan Program. Indeed it is very important that you know more about it.

But don’t you wish you can attend an online Housing Loan Seminar so you can do it from any place in the planet?

Good news: Now you can, right here on this very page! Thanks to Youtube, your wish is granted!

As a side effect of watching these videos, you can actually become an expert in Pag-IBIG Housing loan. You can be proud to discuss it with your circle of friends. Or, better yet, share this article with them.

Videos On The Pag-IBIG Housing Loan

Part 1:

Part 2:

Important topics discussed in the video:

- Eligibility Requirements. Things like age, years of membership, etc. You can also read them here.

- The Loan Amount You can Take. Please read this article for the details. The video also discusses concepts like Capacity To Pay and Loan-To-Value Ratio.

- Loan Document Requirements. Different types of loans require different documents. Read this to find out which one fits your needs.

- How to pay for your Housing Loan. Read this especially if you are based overseas or you salary deduction is not possible for you.

- Advanced Payments. There is no pre-payment penalty on your amortization, but do you know how to do it right? Here are some tips on how to retire your loan earlier than its designated term.

Special Notes:

- However helpful you find this video to be, this is not a replacement of the actual seminar, which is a requirement when you apply for a housing loan.

- Just recently, the Pag-IBIG Fund has raised the ceiling on Housing Loan Amount to P 6 million, from previous P 3 million. The interest rate on socialized housing loans has also been subsidized byPag-IBIG to encouraged low-income members to avail of the program. We’ll have more of this in the up-coming articles.

There you have it. Enjoy watching the videos. It’s like attending a Pag-IBIG Housing Loan Seminar from anywhere in the world.

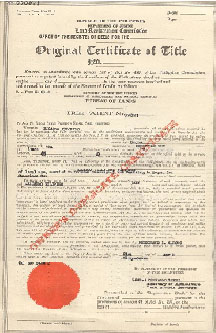

There are still vast amounts of land in the Philippines that have no Land Title under the Torrens System. Usually, the only proof of ownership that the seller has is a Tax Declaration. Buying this type property is a perfect recipe for a real estate disaster. As a buyer, you don’t want to get involved with this kind of real estate deal.

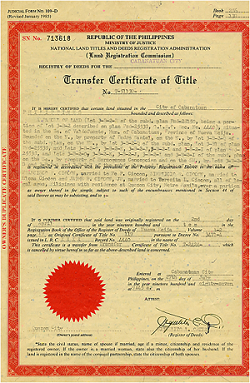

There are still vast amounts of land in the Philippines that have no Land Title under the Torrens System. Usually, the only proof of ownership that the seller has is a Tax Declaration. Buying this type property is a perfect recipe for a real estate disaster. As a buyer, you don’t want to get involved with this kind of real estate deal.  If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.  It works this way: They buy a piece of property, which is usually in a form of subdivision lot that is to be developed in some future time. Hold it for a couple of years or so, while waiting for the subdivision project to be completed and properly developed. Sell high at the current market price, which is usually higher than the cost of acquiring the property.

It works this way: They buy a piece of property, which is usually in a form of subdivision lot that is to be developed in some future time. Hold it for a couple of years or so, while waiting for the subdivision project to be completed and properly developed. Sell high at the current market price, which is usually higher than the cost of acquiring the property. In the case of Pag-IBIG Fund, one of the ways they can check this is by simply looking at your membership records with the Fund. Ever wonder why the Pag-IBIG Fund requires its members to have contributed at least 24 months of contributions? The very reason is that, they want to make sure that you have a steady source of income for the past two years. Somehow that gives them a hint of your employment record.

In the case of Pag-IBIG Fund, one of the ways they can check this is by simply looking at your membership records with the Fund. Ever wonder why the Pag-IBIG Fund requires its members to have contributed at least 24 months of contributions? The very reason is that, they want to make sure that you have a steady source of income for the past two years. Somehow that gives them a hint of your employment record.