“Get your finances in order.”

You have probably read that statement several times on different pages of this website. Usually, it is the response we give to visitors who are asking for guidance on how to get, and eventually be approved for, a housing loan from the Pag-IBIG Fund.

The phrase is very brief but it means a lot of things, which I will attempt to elaborate here in details.

Essentially, I’ll be talking financial talks that relate to the following topics:

- Employment or Business Track Record

- Level of Income

- Credit History

That’s it — just these three things are enough to help you flex your financial muscles so that you’ll be ready to face your loan officer. If you get them right, you’ll be smiling for making such a preparation. And take note, the same concept is applicable also to any loan application from any financial institution like the bank and credit cooperative.

Okay, let’s take them one by one.

Employment or Business Track Record

Quite simply, this is revealed by such question as, “How long have you been in business or in your current work or profession?”

The answer to this question is very important to the lending institution because it tells something about the stability of your income.

There are many ways a private lending institution can get a handle of this information. Depending on your source of income, some banks will be asking you the following:

- Your contract of employment — with stated terms of contract and salary

- Remittances in the Philippines (For OFW)

- Bank Statements

- Financial Statements for the past 2 years (for businesses)

In the case of Pag-IBIG Fund, one of the ways they can check this is by simply looking at your membership records with the Fund. Ever wonder why the Pag-IBIG Fund requires its members to have contributed at least 24 months of contributions? The very reason is that, they want to make sure that you have a steady source of income for the past two years. Somehow that gives them a hint of your employment record.

In the case of Pag-IBIG Fund, one of the ways they can check this is by simply looking at your membership records with the Fund. Ever wonder why the Pag-IBIG Fund requires its members to have contributed at least 24 months of contributions? The very reason is that, they want to make sure that you have a steady source of income for the past two years. Somehow that gives them a hint of your employment record.

So the next time you are thinking about getting a loan, remember to take more time to reflect first on your employment, professional or business history. Stability in your work or line of business is the key. The longer you are in your work, profession or business, the more chances you have to being qualified for the Pag-IBIG Housing loan.

Pag-IBIG Financing Tip #1: Learn about Loan Pre-Qualification and its importance.

Level of Income

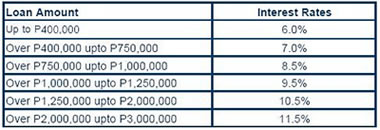

This one is very obvious. The higher your income level, the better chances of getting qualified for a housing loan, and the higher the loan amount entitlement also.

Question: If my income is P 35k per month, am I qualified for a housing loan with Pag-IBIG amounting to P 1.5 M?

Answer: Yes, but you should probably try to settle on a lesser amount of loan or strive to come up with an augmented income. Remember, your monthly amortization will also take a toll on your family’s budget. You don’t want to tie up a bulk of your expenses just paying of your home loan.

The answer to the question above is based on Pag-IBIG Fund’s Guidelines relating the income and member’s contributions to this loan amount entitlement. For more details, please check on the article entitled “How Your Income And Contributions Affect Your Housing Loan Entitlement“.

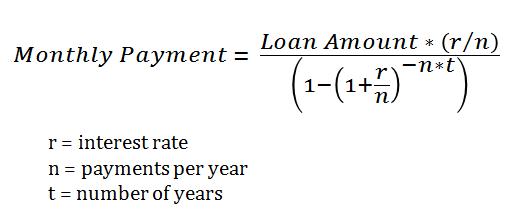

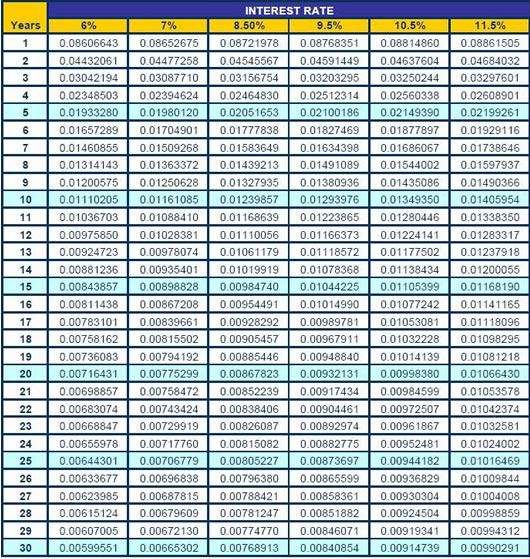

Pag-IBIG Financing Tip #2: As a general rule, you are safe if you select a loan amount and term where the resulting monthly amortization is less than 1/3 of your net monthly income.

Credit History

A borrower’s bad credit history really turns off any lending institution. Be careful about having a history of cancelled credit card because it will haunt you down once you apply for a loan from any bank in the country.

The current Housing Loan Application Form of Pag-IBIG already includes fields about the loan applicant’s credit cards. But some borrowers who have a bad credit history can simply skip on those blank items so that the Pag-IBIG staff won’t bother. But someday soon, it will become a critical part of the housing loan qualification process.

Essentially, what this means to all Pag-IBIG Fund members who want to apply for a housing loan is that, they should not make any Pag-IBIG Loan they can’t make up. Any unpaid loan you have made with Pag-IBIG can definitely affect any loan application you will make with the Fund.

Pag-IBIG Financing Tip #3: Don’t be careless even on small amount of loans. It can make or break your reputation with the Pag-IBIG Fund.

See also: The 5 Cs of Credit.

~~~

“Housing Loan Preparation: How To Flex Your Financial Muscle” is written by Carlos Velasco.