When applying for a Pag-IBIG Housing loan, only two things can happen: Your loan application is either approved or disapproved.

Once your loan application is approved, the real work is just about to start. The most important, and tiring process here, is the registration and transferring of the Title in your name as the buyer of the real property – whether it is a lot-only property, a house and lot, a townhouse or a condominium unit.

Depending on the kind or property that you are buying the Title here can mean any of the following:

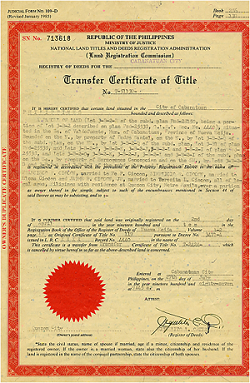

- The Certificate of Land Title, which is also known as the Transfer Certificate of Title (TCT)

- The Condominium Certificate of Title (CCT)

( Related: What if my housing loan application is disapproved? )

Title Registration and Name Transfer

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.

Of course, you can always opt to register the property by yourself, if that’s fine with you and you don’t mind going through the whole process. Again, as already mentioned, if you are buying from an individual, you have to do the legwork of title registration.

In any case, we have outlined below the series of step you need to take to be able to properly register the Title of the property and have it in your name.

(See also : Citizenship, Land Ownership and Pag-IBIG Fund Membership )

STEP 1: Get A Certificate Authorizing Registration

- Go to the office of the Bureau of Internal Revenue (BIR)

- Once you are at the BIR, present the Deed of Absolute Sale (DOAS), and Loan and Mortgage Agreement (LMA)

- Request for the computation of the Documentary Stamps and Capital Gains Tax.

- Then proceed to the designated bank and pay for the Documentary Stamps and the Capital Gains Tax. (Usually this is the Land Bank of the Philippines.)

- Go back to the office of the BIR and your Bank Receipt

- Finally, request for the issuance of Certificate Authorizing Registration (CAR)

STEP 2: Request Issuance of New Title

- Proceed to the Registry of Deeds and present the following documents: DOAS, CAR and LMA.

- Pay transfer tax and registration fees

- Request for the following:

- Issuance of new Title under buyer’s name with proper annotation

- Certified true copy of new title (owner’s copy)

- Certified true copy of new title (RD’s copy)

- DOAS stamped received, LMA stamped received

STEP 3: Pay Tax Declaration

- Proceed to the Assessor’s Office

- Present the new Title with your name

- Pay for the issuance of the new Tax Declaration under the buyer’s name

- Secure a copy of the new Tax Declaration

Take note that the steps just presented are just a part of whole Housing Loan Application Process — probably up to the loan approval stage but prior to the release of the loan proceeds. After you are done with Step 3 above, which is the most critical and time-consuming of them all, you have to go back to the Pag-IBIG Fund office or branch that approved your loan application. Present all the necessary documents required for the release of the loan proceeds.

~~~

This article on Title Registration is written by Carlos Velasco.