Real estate ads are all over the place these days. You see them in the pages of sleek magazines, in the local newspapers, and of course from the Internet. If you are like most buyers, you would probably notice first the price and then the other details next.

But did you know that the list price doesn’t tell you the whole real story? There could be a lot of other information and fees that are hidden from you and which could be a real shocker once the transaction starts to be formalized.

Many ads, not just with real estate but with other products as well, are subtly crafted to catch one’s attention and entice the prospective buyer into part ways with his money?

In real estate, there is a popular phrase that goes, “Caveat Emptor”, which translates to “Buyer Beware”. And when it comes to buying a property, you really have to know what you are getting into. As they say, the devil is always in the details.

This article is written to arm you with the right knowledge of the most important fees and charges related to a real estate purchase. Especially if you are cash strapped, that’s where the headaches really originate.

Outlined below are the various fees and charges — plus, who pays for what — that you need to be aware of.

1. Reservation Fee or Earnest Money (Paid by the buyer). The main purpose of this fee is to initially hold the property and assign it to the account of buyer so that no other interested buyers can take it for a specified period of time. Normally non-refundable, but should the prospect proceed with the transaction, this money will also form part of the down payment.

2. Down Payment (Paid by the buyer). Also called equity payment, this is normally in the range of 10% to 30% of the selling price which can be paid either in one-time or in a series of installments up to 24 months. The down payment is only required if the buyer is planning to finance the purchase by securing a mortgage loan from a financial institution like Pag-IBIG or a bank.

(Related Link : Mortgage Loan Fundamentals)

3. Appraisal Fee (Either paid by the seller or the buyer). Sometimes this is done only if the property is to be financed by a loan from bank or other lending institution. Usually, the appraisal is also conducted by the financing company through their Appraisal Team. The payment for this is collected together with the loan application fee before the loan is even processed. In the case of For Sale By Owner, the seller may also wish to have the property he is selling appraised by a third-party, independent appraiser.

(Related Link: Equity, Appraisal and Loan Amount.)

4. Loan Charges (Paid by the buyer-borrower). When you apply for a home loan, the lender has to make sure that you are a good borrower. And that implies a lot of work on their part. From documentary charges, to credit investigation and processing some documents, they have to make sure that you pay them for the time and efforts they spend doing the tasks.

5. Attorney’s Fees (Paid by both the buyer and the seller). These are fees for the services rendered by a lawyer and are needed by both parties to formalize the legality of a real estate deal . Some legal documents could involve the Special Power of Attorney, Contract To Sell, Deed of Restriction, Waiver of Rights, Deed of Absolute Sale, etc.

6. Agent’s Commission (Paid by the seller). Real brokers and agents are paid by commission based on the selling price of the property, typically in the range of 3% to 7%.

7. Value Added Tax (Paid by the Buyer). If you think the agent is a sucker for taking 5% off the transaction, remember that there is an even bigger sucker who takes on a bigger piece while doing nothing. The rate of VAT is 10% of the selling price, but some real estate properties are exempted from this tax, especially those which are very cheap. Please check with your agent or seller to know if the property could be exempted from EVAT.

8. Capital Gains Tax (Paid by the seller). This kind of tax is usually imposed if the property is being sold at a higher price than it was purchased. Hence, the term “Capital Gains”. But the BIR has pegged this value to 6% of the Selling Price, or Zonal Value, or Market Value whichever is higher.

9. Documentary Stamp Tax (paid by the buyer). This innocent-sounding tax is set to be 1.5% of the Selling Price or the Zonal Value whichever is higher.

10. Transfer Tax (Paid By the buyer). The rate of this tax depends on the location of the property. The range is from 0.25% to 0.75% of the Selling Price or the Zonal Value of the property, whichever is higher.

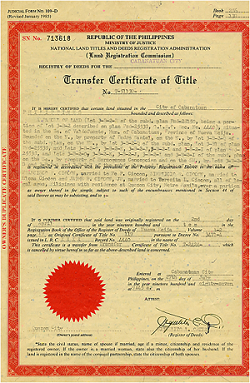

11. Registration Fee (Paid by the buyer). Graduated rate based on the selling price of the property. This one is determined at the office of the Register of Deeds, they have a table there of the updated rate of charges.

12. Realty Tax (Paid by the buyer). The rate also varies from place to place, but you can consult your respective local government for the computation.

~~~

This article is written by Carlos Velasco.

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.