This is one of those topics that a lot real estate buyers are clueless about. Many of them just don’t know how the monthly amortization is determined. This is true for both the first time as well as the seasoned home buyers — and a few real estate agents I’ve met. They simply let the bank, or any lending institution for that matter, handle the computation for them.

Take this particular question shown below which is commonly encountered by real estate sales people.

“How much is the monthly payment for this house which is priced at P1.2M?”

First, any attempt to give a figurative amount to answer that question is meaningless. For one, the question itself is already wrong.

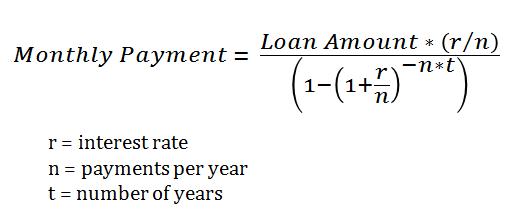

Home Loan Computation: The Amortization Formula

The monthly amortization — or the monthly payment, if you will — is a figure that is dependent on three factors:

- Loan Amount. The actual amount borrowed, usually the selling price less the down payment.

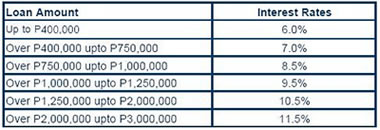

- Interest rate. This figure is usually expressed as per annum value, likewise known as annualized interest rate. If you are familiar with bank financing, you have probably noticed that the interest rate is different for each bank. In the case of Pag-IBIG Housing Loan, the interest rate is dependent on the loan amount.

- Loan term. This tells how long the loan is going to be fully paid; also normally expressed in terms of the number of years. In Pag-IBIG Home Financing, the loan term is usually 15 years or 30 years, though, you may also opt for a shorter loan term.

To determine the monthly amortization, we can simply use this equation:

Essentially, this amortization formula says that

- Given a fixed interest rate and loan term, your monthly amortization is directly proportional to the amount of loan. The bigger the loan amount, the bigger the monthly amortization due.

- Given a fixed interest rate and a particular loan amount, the monthly amortization is inversely proportional to the payment period. The shorter the payment period, the larger the amortization; the longer the payment period, the smaller the monthly payment due.

In other words, while you may be paying a higher monthly amount for a 15-year mortgage compared to a 30-year mortgage, the primary advantage to you is that the loan if fully paid in a shorter period of time.

The main advantage of using the formula above is that it is very handy and versatile. Anyone can use it given any amount of loan, loan term and interest rate.

However, a lot of people are simply lost with Mathematical equations. And not amount of explanations will ever want them to use any formula to determine any figure.

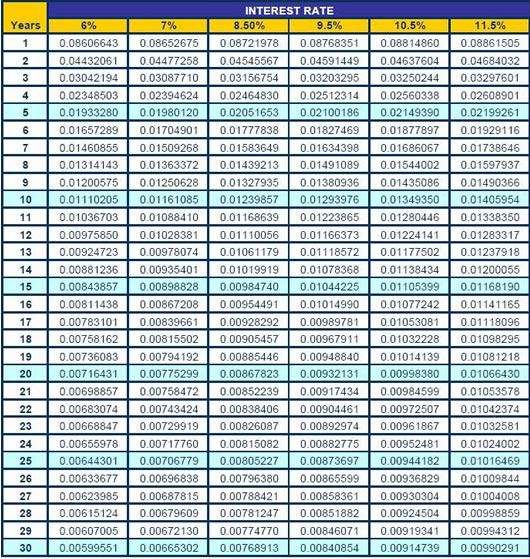

Luckily for them, there is also another way of determining the monthly amortization and that is by using an Mortgage Factors Table such as the one shown below.

The Pag-IBIG Mortgage Factors Table

Take note that this table is made especially for The Pag-IBIG Housing Loan with interest rates effective at the time of this writing (April 2011). You can use it for loan terms starting from 1 year to a maximum of 30 years loan term.

The annual interest rate shown is only the following: 6%, 7%, 8.5%, 9.5%, 10.5% and 11.5%. For interest rates other than these, the table is not applicable anymore. It’s best to use a Mortgage Calculator – a tool which will become available on this website soon.

Given the table above, it is now very easy to determine the monthly amortization by simply following this understandable formula:

Monthly Amortization = (Loanable Amount) x (Factor Rate)

Sample Computation

Consider this hypothetical case: You are buying a Pag-IBIG Home worth P 1.2M and you are planning to put a down payment of P 240,000 which is 20% of the selling price. How much then would be the monthly amortization if you are to pay it is 15 years? How about if the loan is to be paid in 30 years?

Please be guided by the formula above and the interest rates of Pag-IBIG Housing Loan shown below.

From the case in point and looking at the Factor Rates shown at the Table, we can gather the following:

Loan Amount: 960,000 (this is Price 1,200,000 less Down Payment of 240,000 )

For 15-Year Mortgage, the Factor Rate = 0.00984740.

For a 30-year mortgage, the factor rate = 0.00768913

When using this formula, take note we are not putting into consideration some other trivial payments like fire insurance, mortgage redemption insurance, membership dues and others. We are leaving that for the sake of simplifying the illustration.

***

Update: A more detailed article about the Amortization and Mortgage Calculator has been made on this website. Please check it now.

~~~

“Pag-IBIG Housing Loan Amortization Demystified” is written by Carlos Velasco.

Good day po,

Kaunting favor lang po kung pwede po ba akong makahingi ng copy of my loan statement,at gusto ko din pong malaman kung magkano pa ang dapat kung bayaran for the next 3yrs.

maraming salamat.

@nena:

Please request it from the Pag-IBIG branch where you applied for your Pag-IBIG Home Loan.

good morning po. ask lang po ako if mayroon kayong house loan P1,000,000. magkano po ang interest if i will pay it for 30 yrs.magkano po ang downpayment at interest? ano po ang mga kailangang requirements para maka avail? gusto ko po kasing kumuha ng housing loan sa PAG-IBIG. salamat po. sana masagot nyo po ako as soon as possible…bago po ako umalis papuntang japan this july….

can I be updated of my housing loan payments? Thank you

hello po, isa akong OFW pwede bang makakuha ng housing loan sa inyo? pls reply me thnx.

@Mary:

Actually, the down payment is one of the requirements. As to the occupancy, that’s not the concern of Pag-IBIG anymore. You have to ask that one to the seller of the house.

@benilda:

Please check this article for the answer:

https://www.pagibigfinancing.com/articles/2011/pag-ibig-loans-interest-rates-penalties-and-defaults-part-1-of-2/

Hi ask ko lang po sana f pwede po ako makapag loan…kasi po may binili po akong lupa so ilang buwan ko po hnd nabayaran sa developer in house kasi siya kaya malaki ang interess… pwede ko ba ito i laon ung balance si 300k…gusto ko sana mag loan ng 300k sa pag ibig para mabayaran ko na ng buo…mag kano po ang interests? matagal po ba ang poroseso at ano ang requirments?sana masagot niyo now tnx…

Gud day po, may housing loan po ako na 650,000 noon year 2004. Ang interest rate po 12% if on time ang payment at 14% pag late payments. Since ngbago na po ang rates, pede po ba marecompute ang loan ko sa existing 7% interest ngayon? and also ano po ba un re-pricing kasi po nakalagay sa record ko na 14% – 16% ang interest rates, indi po ba napakataas naman ng interest? At ano po ba ang interest rate noon 2004? Salamat po ng marami.

@Flora:

No, you are not allowed to restructure down to the current rate. On the lighter side, Pag-IBIG is actually offering a rebate if you are paying on time and before your due date. This has been on-going for the past couple of months already.

@jb:

This may take a long time and you have to coordinate this one with your developer.

Hi admin,

How about po ung sa Interest and Principal? pano pu makukuha ung Principal and Interest? Formula po sana kung meron.

@Jake:

You don’t need any formula for those (interest rate and principal amount of loan). They are usually given.

@Admin:

what i was pointing at is the result from the calculator. There are 4 columns DATE,PRINCIPAL,INTEREST,BALANCE. what i dont understand, is why the principal is increasing yet interest is decreasing. i know the sum of the two is the monthly mortgage, but im confuse on how the thing works.

Thank you sir.

Dear Sir

Since last april 2001 we’re still updated from our monthly payments.. the 25th year of our terms of payment as per the contract agreemeent ended last July 7 2008.. In addition to that the principal borrower which is my father died on that same month and year… can I apply for a restructure of the payment penalties and how the MRI & TAV can take effect in this matter to lessen the amount which I have to pay .. I want to pay all the remaining balance so that the property will be awarded to us…. More over they are charging us penalties for the period of July 7 2008 up to 2011 do i have to pay for that also? thanks and have

@Jake:

To arrive at those figures requires a review of Mathematics. Please refer to this link for more help:

http://math.about.com/library/weekly/aa101103a.htm

@sid:

Are you a co-borrower to the loan? To be very strict, you still be required to pay the penalties that go with that account.

Hi…

Is credit card acceptable to make a fully payment or final payment for the houseing loan? if that is so, do you take a US credit card?

Thank you so much!

Hi admin..

I paid all the remaining balance payment for our housing loan in pag ibig worth abouth 1 million including the penalties etc. My mother is the co borrower, my father is the main borrower ( deseased ). can we request to pagibig to divide the property in to 2 with my mother ( Co-borrowers ) consent of course. for the awarding of the certificate of title. can pagibig help us with all the procedure for all this minor legal conflicts..

thanks

Rebate?..so.possible po ba un since naka-issue na po ako ng PDC sa developer..4700,pero nkareceive po ako ng letter from PAGIBIG,and accordingly,kaya daw naging 3300 due to ontime payment..sobra kung ganun ang payment ko sa developer or PAGIBIG? make-claim o mkukuha ko pa po ba ung rebate na un? Maraming salamat po.

Paano po pala kung halimbawa po,nasa equity stage pa lang po sa developer,hindi na po kaya ipagpatuloy,pero gusto pong saluhin ng kapatid na working pero hindi po member ng pagibig,pwede po ba un?thank po ulit.

MONTHLY AMORTIZATION

>>> Principal & Interest

>>> SRI/MRI

>>> Fire

>>> Contribution

Total

I would like to know about the contribution charge. For what purpose this contribution is intended for?

di po ba pwedeng magbayad ng monthly amortization dito sa bulacan branch nyo pero ung property pong nakuha namin sa quezon city? dito po kami nagbabayad ng monthly contribution sa tabang branch ninyo. maraming salamat po!

@anabel:

Normally, if you pay over the counter, it must be at the branch where you got the loan. But you can pay it at any accredited collecting agents like SM and some banks.

where/when can we get the table for the newly approved interest rate last Dec 2011 that will start at 4%? when would be the effectivity date of this?

what if for example, on my 3rd yr of payment,i’v decided to pay an advance payment of 200K for a loan worth 1.3M payable w/in 15 yrs., will there be an adjustment on interest rate for the remaining payments?, wc will be 9.5% from 10.5%

Paano po ba malalaman kung pwede na akong mag-apply ng housing loan?

11 months aku ng trabaho as OFW at 11 months lng nahulogan ang pag-ibig ko,,ngaun ku2ha aku ng bahay thru pag-ibig kaso requirements nila 24 months na nahulogan ang pag-ibig,,anong kylangan kng gawin pra mkapg avail ng bahay sa pagibig,????

Bago po ako magtrabho abroad Pag-ibig member na po ako.Kaso nung nakapagtrabaho na po ako dito s Dubai at hindi ko na po naituloy ang paghuhulog sa account ko sa Pag-ibig saktonng 2 taon na rin po…Ano po ba ang dapat kung gawin? Gusto ko po ulit mahulugan ito.Kasalukuyang nandito pa rin po ako sa Dubai nagtatrabaho. Sana po ay masagot ninyo ang mga katanungan ko at kung ano po ba ang dapat kung gawin. Maraming salamat po.

Good day Admin,

Tanong ko lang kung tama ba ung computation na binigay sa amin ng seller ng bahay ni bibilhin namin. Based kasi sa table nyo dito, 1,000,000.00 is 8.5% interest lang. Eto po yung computation na binigay sa amin.

Loan Amount: 1,000,000.00

Interest Rate: 9.5%

Monthly Ammortization for 30 years: 8408.54

Saka same lang po ba ang interest rate kung mas shorter term ang kukuhanin namin? Lets say 10 or 15 years payment terms lang.

Thank you,

Jeff Villaflor

@Jeff:

Please use this tool to determine the monthly amortization:

https://www.pagibigfinancing.com/articles/2011/mortgage-calculator-and-amortization-schedule-plus-how-to-save-on-your-loan-payments/

@Rose:

You can still continue with your contributions by having someone pay it over the counter at the branch where your records are kept.

@Hon:

YOu have to wait until you have made 24 months contributions.

@Mark:

Once you are qualified to apply for a housing loan, that’s it.

@grace:

The interest rate may still remain unchanged, but your loan term may be lower. Please request a computation at the branch once you have decided to pay in advance.

@PS:

Please check the Side Bar of this website. We have posted the current interest rates there.

Sir, good day po,ask ko lng po if magkano ang monthly amort. sa 780000 for 25 years.

Thanks,