“Am I qualified for a Housing Loan?”

This is a recurring question which appears on this website as comments under different articles with different topics. This article is intended to address that question once and for all and also show you some useful tips.

You can actually personally determine if you are eligible for a housing loan based on the following:

- Your Pag-IBIG Membership

- Your Age

- Your Capacity To Pay

- Other Pag-IBIG Loans

We’ll try to elaborate each one on the succeeding paragraphs.

Your Pag-IBIG Membership Status

You need to remember the following basic requirements for Pag-IBIG Fund Members.

- You must be an active Pag-IBIG member for at least 2 years and has contributed a minimum of 24 monthly contributions.

- Both the principal borrowers are subject to the above mentioned requirement.

- Up to three Pag-IBIG Members may avail of a single housing loan (same collateral) provided they are related within the second civil degree of consanguinity.

Question: Can I pay 24 months one-time and then avail of the Pag-IBIG Home loan immediately?

Answer: Not anymore, the new Pag-IBIG Law of 2009 has changed the rule. But, you may still pay 24-months one time (Pag-IBIG will be more than happy to accept it) and wait for another 24 months to apply. (Other branches will allow you to wait for just 12 months.)

Pag-IBIG Financing Tips on Membership:

- To re-activate your Pag-IBIG Membership is very simple: just pay for the monthly contribution.

- If you have been moving from one company to another, always make sure that you consolidate your Pag-IBIG contributions past and present. You can do this by requesting it from the Pag-IBIG Office.

- Don’t be in a hurry to get a housing loan. You need to establish a good record so that your application will be easier by the time you do it.

- Read the article entitled “Why This Question Is Wrong: ‘Can I Pay The Whole 24 Months Contribution One-Time So That I Can Avail of the Housing Loan?’“

For the complete list of document requirements, please check this article.

Your Age

- You must not be more than 65 years old at the time of loan application.

- You must not be more than 70 years old at the date of maturity.

- You must be insurable.

Advanced age really is a hindrance to getting a housing loan. And take note that this is true whether you are using Pag-IBIG or any Bank.

Pag-IBIG Financing Tip: If you can afford it, apply for a housing at a young age.

Your Capacity To Pay

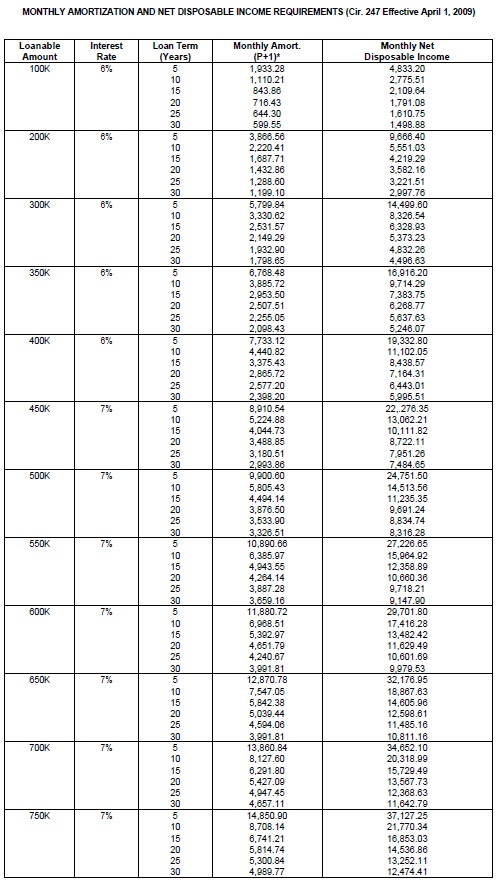

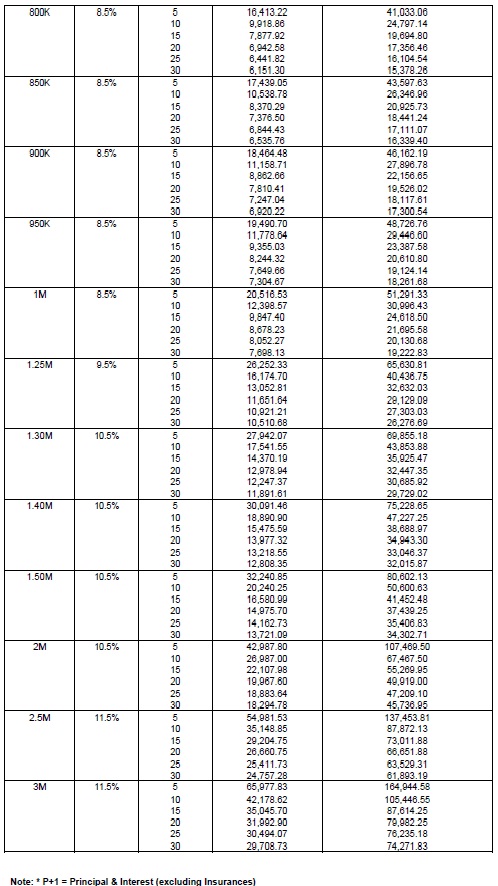

As a general rule, your monthly amortization should not exceed one-third of your gross income. This is the rule used by many financial institutions when qualifying a loan applicant.

As a general rule, your monthly amortization should not exceed one-third of your gross income. This is the rule used by many financial institutions when qualifying a loan applicant.

But when it comes to Pag-IBIG Financing, your monthly amortization (principal + interest) should not be more than 40% of your Net Disposable Income.

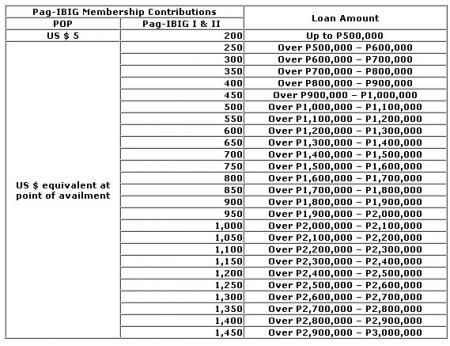

Actually, there is a table that you can use to determine much loan amount you can get given your income, contributions and loan term. To see the Table, please refer to the article on “How Your Income And Contributions Affect Your Housing Loan Entitlement”.

Pag-IBIG Financing Tips:

- Have your finances in order by saving enough for the Down Payment (or Equity).

- You need to show some proof of income. Prepare the following documents: Pay Slips, Income Statements, Employment Contract (with indicated salary).

- Learn about the 5’s of Credit

- If your income is insufficient, you may take on a relative (within the second civil degree of consanguinity) or your spouse and tack-in your contributions then apply for a housing loan.

Other Pag-IBIG Loans

- You are only allowed one Housing Loan at a time. If you want to take another one, you have to pay your existing loan.

- If you have previously availed of the housing loan, make sure that it was not foreclosed, cancelled, bought back, or subjected to dacion en pago.

- If you have an outstanding Multi-Purpose Loan, your payments must be updated and it must not be in arrears at the time of application.

It is important that you take note of the information presented here before you apply for a housing loan from Pag-IBIG.

And if you are disqualified for some reasons, please remember that Pag-IBIG is not the only Home Financing option available. Or, you may want to try applying again in the future. Your loan application may be approved by that time.

~~

“How To Check If You Are Qualified For A Pag-IBIG Housing Loan” is written by Carlos Velasco.

This is another word for Down Payment, a term mostly used by Banks; Pag-IBIG uses the term equity to mean the same thing.

This is another word for Down Payment, a term mostly used by Banks; Pag-IBIG uses the term equity to mean the same thing.