Every member of the Home Development Mutual Fund — or anyone who desires to be one – should know that there are basically three types of benefits that are available to qualified members. They are the following:

1. Short-Term Loan — This is the Multi-Purpose Loan Program of the Pag-IBIG Fund that is payable in 24 months. The one thing that makes it unique is that the loan amount that can be granted to you is dependent on your “savings” with the fund. Let’s discuss the savings part in the succeeding paragraphs. A lot of people call it with many names such as personal loan, salary loan, cash loan, etc. It doesn’t matter what name you call it, you can use the proceeds anyway you want.

Click this link to know more about the Pag-IBIG Short-Term Loan Program.

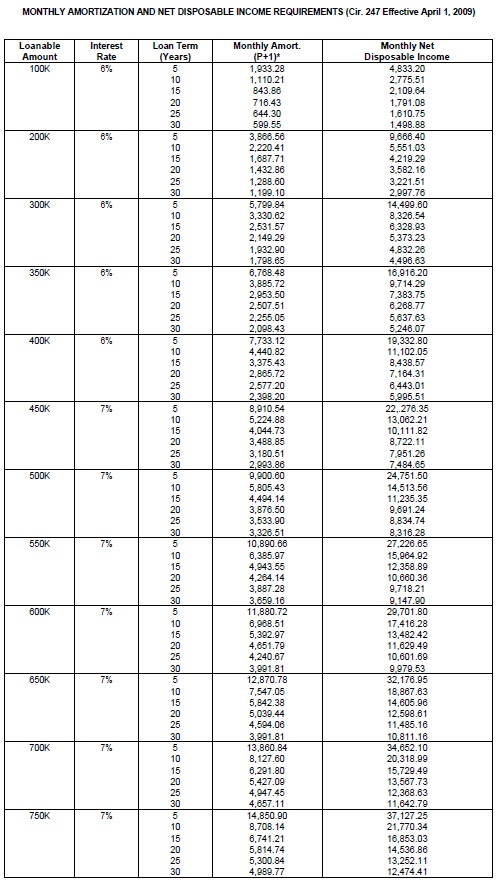

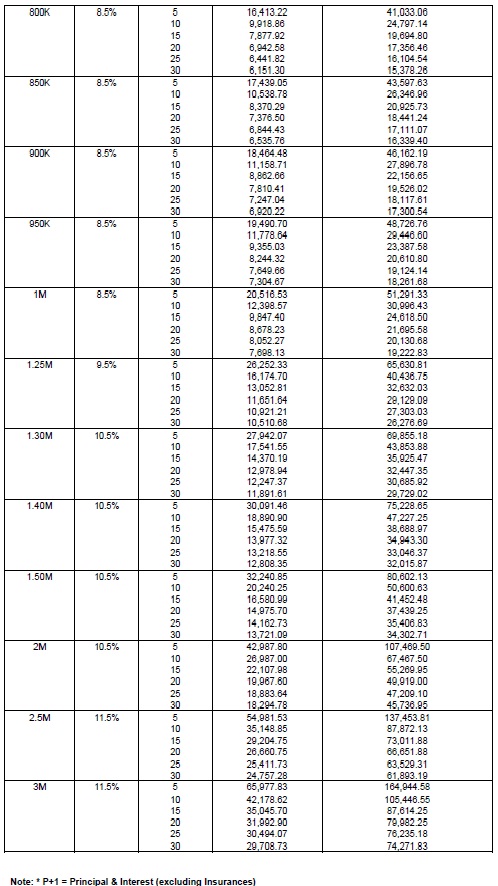

2. Housing Loan — To many of its members, the Pag-IBIG Fund is almost synonymous with Housing Loan. This is a long-term home loan program that qualified members can tap in order to finance the purchase of a real estate in the Philippines. The article entitled Pag-IBIG Housing Loan 101 is a good place to start learning about this program.

3. Provident Savings — Your contributions to the Fund are like your Time-Deposit Account in the bank. It earns interest overtime and you can withdraw it, too. We’ve already mentioned a few things about this in the past article, but here we’ll elaborate more in this article, so keep reading.

Provident Savings — What Is And How It Works

I searched for the meaning of the word “provident” and I got a good response. Provident (an adjective) means “making or indicative of timely preparation for the future.” Thanks Google, I don’t have to open my good old dictionary.

I searched for the meaning of the word “provident” and I got a good response. Provident (an adjective) means “making or indicative of timely preparation for the future.” Thanks Google, I don’t have to open my good old dictionary.

The meaning of the word “savings” should be easy, right? It is explained below.

Savings here refer to your membership contributions to the Pag-IBIG Fund. If you really think about it, that’s your own money that you “saved” with the fund. If you are locally employed in the Philippines, you know for a fact that your employer is also mandated by Law to contribute to your savings.

The Pag-IBIG Fund is one huge organization that pools together all the savings of all its members and invests that money by financing real estate development projects and mortgage loans which would eventually be beneficial to its members. As such, this money is expected to grow, or earn, over the course of time.

As a member, you must also be aware of the term Total Accumulated Value (TAV), which is your total contributions plus that of your employers (if you are employed) and the dividend earned by that money.

So essentially, Provident Savings is the TAV money which you can claim in some future time as a result of becoming a member of the Pag-IBIG Fund.

Provident Claims Or How To Withdraw Your Money

This part is exciting and irritating as well.

Here’s a minor irritation you have to deal with: you can’t just get your money anytime you need it. There are set guidelines on when you can apply for provident claims.

Here are the six instances when you are entitled to get your money from the Pag-IBIG Fund. The document requirements are also listed for each of the respective category of provident claims.

1. Membership Maturity – Regular members of the Pag-IBIG Program or the Pag-IBIG I can apply for provident claims upon maturity of their membership. Maturity here means having made an equivalent of 240 monthly contributions, so that’s roughly 20 years. (See the Basic Document Requirements below.)

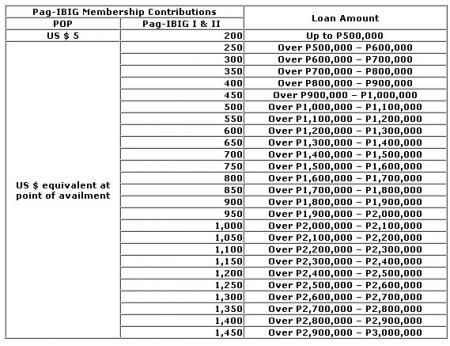

Members of Pag-IBIG Overseas Program have their maturity date set from 5 to 20 years. They are advised to have their POP Passbook when applying for the provident claim.

2. Retirement – The retirement can be as early as 45 years old to the mandatory age of 65. The following are the important documents to bring:

- Notarized Certificate of Early Retirement (For Private Employee, at least 45 years old)

- SSS/GSIS Retirement Voucher or any two valid IDs

- For AFP, Philippine Navy and Army Personnel (Any of the following: Order of Retirement, Updated Statement of Service, Statement of Last Payment )

3. Separation from the service due to health reasons

Important Documents:

- Physician’s Certificate/Statement

- Notarized Sworn Employer’s Certification that member was separated from the service due to health reasons

- Latest SSS Disability Voucher (For Private Employee)

4. Permanent and Total Disability or Insanity

Important Documents:

- Physician’s Certificate/Statement of Insanity

- SSS Total Disability Voucher (If Private Employee)

- For AFP, Philippine Navy and Army Personnel: ( Updated Statement of Service, Statement of Last Payment, Compulsory Disability Discharge Order)

5. Permanent Departure from the country

If you have another to call home and you finally said goodbye to the Philippines, here are some documents to prepare:

- Notarized Sworn Declaration of Intention to Depart from the Philippines Permanently

- Photocopy of Passport

- Any of the following : Immigrant Visa, Residence Visa, Settlement Visa

6. Death

That dreaded word. Beneficiaries or heirs should prepare the following documents:

- Member’s Death Certificate issued by NSO

- Certification from Funeral Parlor

- Notarized Proof of Surviving Legal Heirs

- Notarized Affidavit of Guardianship (For children 18 years old and below, or physically/mentally incompetent)

- Birth Certificate of all Children, if any, issued by NSO or Baptismal/Confirmation Certificate

To establish relationship with the deceased member, the claimant shall submit any of the following:

- Member’s / Claimant’s Birth Certificate issued by NSO

- Member’s Marriage Contract, if married, issued by NSO

- Certified True Copy of Member’s/Claimant’s Baptismal/Confirmation Certificate

- Certificate of No Marriage (CENOMAR) (For Single Only)

Basic Document Requirements

On top of the document requirements above, the following document should come handy:

- Duly accomplished Application for Provident Benefits (APB) Claim

- Two (2) valid IDs

- Updated Service Record (For government employees)

- Special Power of Attorney and two (2) valid IDs each of the Principal and Attorney-in-Fact (If member cannot claim personally)

~~~

“Money Matters: Pag-IBIG Fund Provident Savings and Provident Claims” is written by Carlos Velasco.