Have you ever entertained that thought of buying a home of your own?

If not yet, beware! It’s one of those nasty things that could give you sleepless nights… next only to Facebook.

From the design of the house and the size of the lawn, to the number of rooms and the kind the furniture to buy, we all want to have the best house as much as possible.

Large lawn with a nice garden, a 3-car garage, a relaxing view of the city, friendly neighborhood, spacious living room, sound-proof entertainment room for the guest, large kitchen for the chef in you, close to downtown, and finally just within budget.

There’s just one problem: You can’t have it all – especially if you factor in the money, money, money.

A Dream House Is Good, But…

Whether you like it or not, everything comes with a price. If you want to have a high life and experience the most luxurious living on earth, you have to be ready to pay for it.

Want to buy your dream house?

Sure! But first, wouldn’t it be nice if you reach the level of income that you have been dreaming about?

A Functional House — Your First Home To Call Your Own

The wise buyer keeps everything in proper perspective. You want to be able to enjoy living in your house with your family so that eventually you can call it a home. And at the same time, you don’t want it to be too much of a drain on your finances.

The wise buyer keeps everything in proper perspective. You want to be able to enjoy living in your house with your family so that eventually you can call it a home. And at the same time, you don’t want it to be too much of a drain on your finances.

Of course that’s possible. But first you need to wake up from dreaming about your “dream house”. Getting a reality check and thinking about owning a functional house that fits your needs and your budget is far more rewarding.

Second House As Dream House? Yes, Way!

Forget about that dream house, especially if you are just buying your first home. You can always buy that dream house later, or get to build a custom-designed one, once you are able to afford it.

First things first: you need a functional house.

To this end, let the following tips guide you along the way.

Tip #1: Your Budget — Buy A House That You Can Afford.

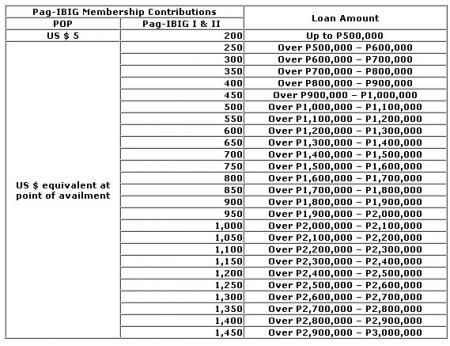

That means you have to work on your budget. If you are like most real estate buyers, you would probably need a housing loan to purchase the house. Thanks to Pag-IBIG Housing Loan, that should not be a problem.

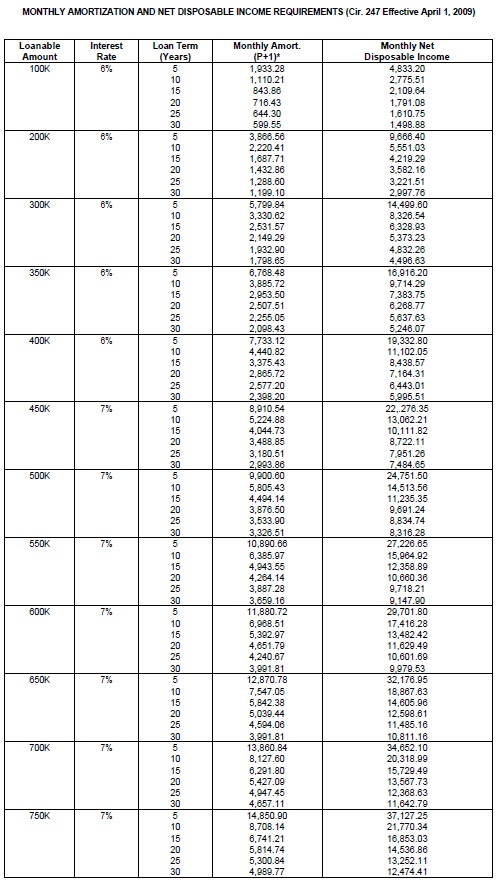

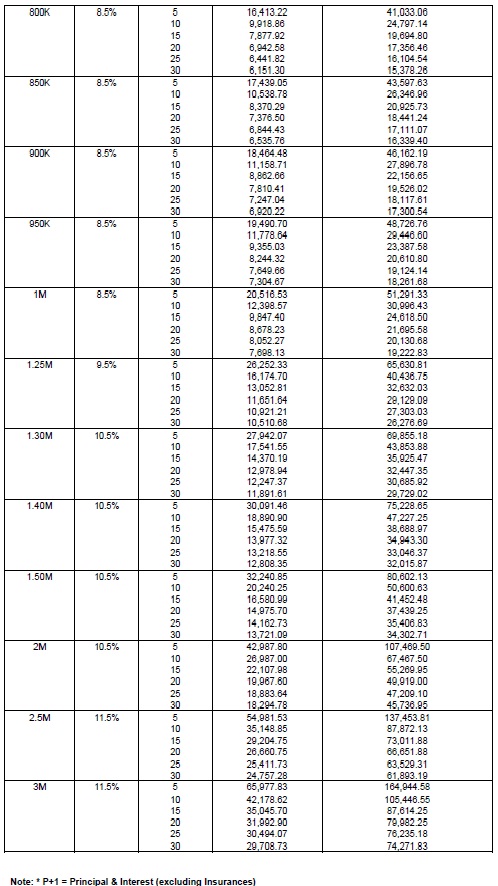

You need to determine how much you can comfortably set aside each month and send it to the mortgage company – that’s the Pag-IBIG Fund or your favorite bank. A good rule of thumb to follow is that, your monthly amortization should not be more than one-third of your gross income. If you want to be really safe, use Net Income instead of Gross Income — that’s even better. If you are a two-income family, it’s best if you can use just one income to cover the monthly amortization expense.

It may come as a surprise to you, but one of the mistakes made by real estate buyers is buying a house they cannot afford.

Yes, you read it right. It’s possible to buy a house that you can’t afford. And that involves being dishonest about your income and finances. But sooner or later, it’s this kind of buyer who eventually winds up eating the dust and losing the property. Avoid this kind of trick as much as possible.

Tip #2: Location – Accessible, In Good Neighborhood.

Did you know about the top three most important things to consider when buying or investing in a real property?

It’s location, location, location.

That’s called hammering it down your head. And I hope, you’re getting it so far.

A good location is one that is highly accessible to public transportation. This is especially true if you have kids who are going to school.

Another thing to consider is the property’s proximity to the amenities and facilities of your city or town. Are there malls and recreational centers nearby? How far is it from the market?

Take note that a good location could also affect the value of the property. For example, properties that are closer to the business center tend to be priced higher than those farther down the town. You need to strike a balance between this and the budget that you set.

Above all, is the neighborhood safe and flood-free? Buying in a good neighborhood is one of the keys that determine whether your property will go up or go down in value.

Tip #3: House Features and Specifications – Must Be Functional

What is a functional house? Only you have the right answer to that one. After all it has to do with your needs and of those people who will be living there.

Before you even begin taking a look at a house, consider that you have the following nailed down on your list:

- the number of bedrooms

- the number of bathrooms and toilets

- car park

- single-storey or two-storey?

That’s the basic. You could go on and on with the list — things like the hot and cold shower, built-in cabinets, fancy faucets, etc. Of course, the more you have those, the more price add-ons you can expect. You need to decide at the onset if those things are necessary upon move in or you can do away without them and just have them later on when you are already living in the house.

The best part about following the suggestions above is that you get to enjoy the house and have a peace of mind knowing that you have invested on the right thing.

~~~

“Forget About That Dream House, Buy A Functional House Instead“ is written by Carlos Velasco.

This is another word for Down Payment, a term mostly used by Banks; Pag-IBIG uses the term equity to mean the same thing.

This is another word for Down Payment, a term mostly used by Banks; Pag-IBIG uses the term equity to mean the same thing.

You may think that getting the assistance of a real estate agent will make the property more expensive. Whoever told you that must be very ignorant of the whole process.

You may think that getting the assistance of a real estate agent will make the property more expensive. Whoever told you that must be very ignorant of the whole process.