Allow me to start off this article by quoting the question recently posted by a visitor of Pag-IBIG Financing Website:

“My husband and I are planning to buy a condo or a townhouse that’s worth P1.5M. We understand that the loanable amount is 3M. But the loan pag ibig can give is based on the monthly income of both husband and wife, is that right? The usual problem that we have is that how to pay for equity…. My question is, can we loan a full amount of 1.5M to Pag ibig so that we don’t have to pay for equity?”

That question is very important because it raises a lot of topics every Pag-IBIG Member should be aware of. Let’s tackle the following as it relates to the article:

- Equity

- Appraisal

- Maximum Loan Amount

Your knowledge on these topics may save you from facing a possible foreclosure – something that you don’t want to happen with your property.

Now, before discussing the above terms, a general introduction on home loan is worth mentioning.

In general, when you apply for a real estate loan, you will be asked to pay for a down payment; say 20% of the appraised value of the property, that’s the standard down payment. The loan amount will actually be based on the appraised amount less the down payment.

To illustrate, assume for a moment that the appraised value is P 1,000,000 and you are asked for a 20% down payment. That means you are to personally raise P 200,000 before you are granted the P 800,000 loan. And if you are qualified for the P 800,000 loan, your monthly amortizations will be used to cover the interest and principal payment against the borrowed amount of P 800,000.

(See also: Mortgage Loan Fundamentals)

Now, back on track…

Equity

This is another word for Down Payment, a term mostly used by Banks; Pag-IBIG uses the term equity to mean the same thing.

This is another word for Down Payment, a term mostly used by Banks; Pag-IBIG uses the term equity to mean the same thing.

The equity refers to your stake (or interest) on the property. This concept is very important because, in the eyes of the money lender (Bank or Pag-IBIG Fund), the more equity you have on the property, the more serious you are in paying the loan.

If you initially put down an equity of 20% of the appraised value the property, it means that you own 20% of the property; the other 80% is owned by the money lender. As you pay off your loan, your equity also grows over time.

Appraisal

Pag-IBIG Fund, or any lending institution for that matter, can’t just loan you any amount. They base it, first and foremost, on appraised value of the property and then on your capacity to pay.

Appraisal is simply the process if estimating the value of the property. Take note of the word “estimate,” … however advanced the tools being employed, appraisal is really just an estimate. That’s why it is not uncommon to see that the selling price of the property is very different from the appraised value of the property by a big factor. It would appear that the Seller has a different appraised value of the property he is selling compared to the Lender.

If you are getting a loan, its always the Lender’s Appraisal that determines the price and therefore your loan amount. After all, the flow of money is from them to you.

In the example above, just because the selling price of the condo unit is P 1.5M doesn’t mean that Pag-IBIG will also base it on the P 1.5M. This may be the case for Pag-IBIG accredited projects with their partner developers; otherwise, Pag-IBIG will conduct an appraisal on the property.

Maximum Loan Amount

Okay, you should know by now that Pag-IBIG Fund grants a maximum of P 3M only. That doesn’t mean you are also eligible for a 3-million loan. There are other factors that come into play.

Actually there are two maximum loan amounts that you must be aware of.

#1. Amount based on the appraised value minus your equity. If you are lucky, you will be granted with this amount.

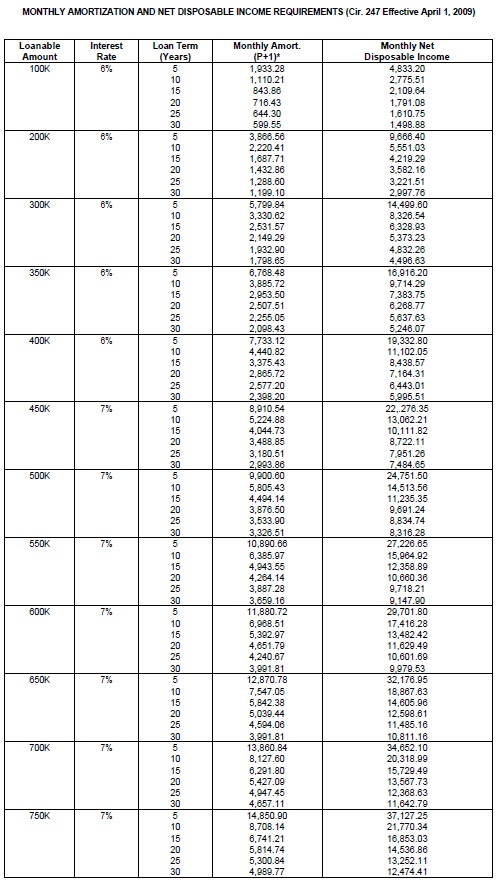

#2 Amount based on your income, in other words, based on your capacity to pay. It goes to say that the bigger your income, the more advantageous on your part, because you are eligible to get a bigger loan amount also.

Don’t miss: Your Income, Contributions and Loan Entitlement.

~~~

“Equity, Appraisal And Loan Amount – What You Should Know About These“ is written by Carlos Velasco.

It is a well known fact that land ownership in the Philippines is granted only to Filipino Citizens and Philippine Corporations with at least 60% interest by Filipinos.

It is a well known fact that land ownership in the Philippines is granted only to Filipino Citizens and Philippine Corporations with at least 60% interest by Filipinos.

You may think that getting the assistance of a real estate agent will make the property more expensive. Whoever told you that must be very ignorant of the whole process.

You may think that getting the assistance of a real estate agent will make the property more expensive. Whoever told you that must be very ignorant of the whole process.