There are two featured properties for this month. One is a residential lot in Sta Rosa, Laguna and the other one is a condominium unit in Mandaluyong. Both are elligible for Pag-IBIG Financing, according to the sellers.

If you are interested in any of the properties that we posted here on this website, please contact the seller directly. The seller’s contact details are always indicated with each posted property.

For those who don’t know it yet, you can post any Pag-IBIG accredited real estate that you want to sell here in this website. The Marketplace Section is intended for that purpose.

Before showing you the properties, we’d like to share with you the sister-website that is intended to spark the entrepreneurial spirit of the Filipinos. If you are a business owner or you want to start a business in the Philippines anytime soon, the NegosyoBuilder.com website

is the right place to start to learn about the intricacies of doing business in the country. It’s new website, but like the Pag-IBIG Financing, it will soon be loaded with rich, helpful and practical business-related topics.

So, don’t forget to visit NegosyoBuilder.com. See you there!

Property #1 : Lot for Assume at Pramana Residential Park, Sta Rosa, Laguna

Location: Lot 3, Blk 24, P1B, Pramana Residential Park, Sta Rosa, Laguna

Selling Price: 1,300,000

Pramana Residential Park(Sta Rosa, Laguna)

- The country’s first and only residential park developed by Greenfield Development Corporation

- 50% residential space and 50% open space/parks to give its residents wide open place to relax

- 40km from Makat Business District,

- 25km from Alabang,

- 20 minutes drive to Tagaytay.

- Accessible to 3 major interchanges (Mamplasan, Sta Rosa, Greenfield Exits)

Selling Price and Payment Terms

- 157 sqm. lot only

- Selling Price =1.3M

- Assume remaining balance of 1.37M to PAGIBIG = monthly amortization of 14,079php for 30yrs, (4 months already paid)

Amenities:

- Wi-Fi System within the whole village

- Mediation Garden and Gazebos

- Pocket Parks, View Corridor

- Chilren’s Play Area

- Outdoor Basketball Court

- Clubhouse and Swimming Pool

Recreation

- Enchanted Kingdom

- Tagaytay

Commerical Center

- Paseo de Sta Rosa

- Walter Mart, Taget Mall

- SM Sta Rosa

- Robinsons Sta Rosa

- Rustan’s Shopping Center

Schools

- St. Scholastica’s College

- Brent International School

- De La Salle University

- Don Bosco College

- UST (future site)

Hospitals

- South Luzon Hospital & Medical Center

- Sta Rosa Hospital

- Medical Center

- St James Hospital

- Fortmed Specialty Clinics

Or email him at cj.elizaga@gmail.com

Property #2 : Condo unit For Sale, California Garden Square, Mandaluyong City

Location: California Garden Square Mandaluyong City

Selling Price: 3.4M w/appliances/ Fully furnished LOFT TYPE 57.8 square meters

NEGOTIABLE!!!!

With 2Bedrooms, 1Living Room, 1kitchen room, beranda. Fixed Cabinets, fixed beranda Grills, Hot and Cold, and Appliances. READY TO OCCUPIED

80% in bank financing at Pag-Ibig

20%.( 24 months) NO ENTEREST!!!

Down Payment – 50,000

2 months deposit. Upon approval in PAG-IBIG / BANK FINANCING. LIPAT AGAD!!!

Features and Amenities

- 15min. walk SM MEGAMALL

- 10min. walk SHANGRILLA MALL

- 8min. walk STARMALL

- 5min. walk market(palenke)

- 2-3 min ROBINSON SUPERMARKET

- 1 min RICKY REYES HAIR PARLOR

- 1 min MINISTOP Inside;

- With POOL, CLUB HOUSE, GYMN, RESTAURANTS, LAUNDRY SHOP, BAKERY SHOP, WATER STATION.,

- and many many more commercial areas infront, insides and outsides of the sight.

Very accessible near at International School, Day Care Center, Medical Center, etc.

Please cal me (Rowena Okazaki) in Japan Rowena Okazaki (0081)9017858066.

Email Address : srk.wenny_629@yahoo.com

Or Philippine side, Maricel Abuan 63-9497880733 / (Mother)63-9127392581

There are a lot of Pag-IBIG members who are into these situations:

There are a lot of Pag-IBIG members who are into these situations:

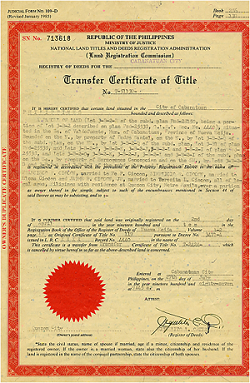

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.  There are many reasons why borrowers default on their loan payments. Luckily for the Pag-IBIG members, there’s a Loan Restructuring program that they can take advantage of as a remedy to their delinquent accounts.

There are many reasons why borrowers default on their loan payments. Luckily for the Pag-IBIG members, there’s a Loan Restructuring program that they can take advantage of as a remedy to their delinquent accounts.